In today’s fast-paced world, the need for instant money transfers has become a necessity. One of the solutions that cater to this demand is PayPal Inst Xfer, an efficient way to send and receive funds instantly. This article delves into the intricacies of PayPal Inst Xfer, shedding light on its functionalities, benefits, and security measures.

PayPal, an established name in online financial transactions, offers users the convenience of transferring money with a single click. This article will guide you through every aspect of PayPal Inst Xfer, from its inception to how it transforms the way we handle financial transactions.

Contents

What Is PayPal Inst Xfer?

At its core, PayPal Inst Xfer is PayPal’s instant money transfer feature. This service allows PayPal users to send and receive money instantly, bridging the gap between the digital and physical worlds of finances. Gone are the days of waiting for days or even weeks for money to arrive in your bank account; with PayPal Inst Xfer, the funds are available almost immediately.

You May Also Like: When is PayPal Return Shipping Ending?

How Paypal Inst Xfer Works

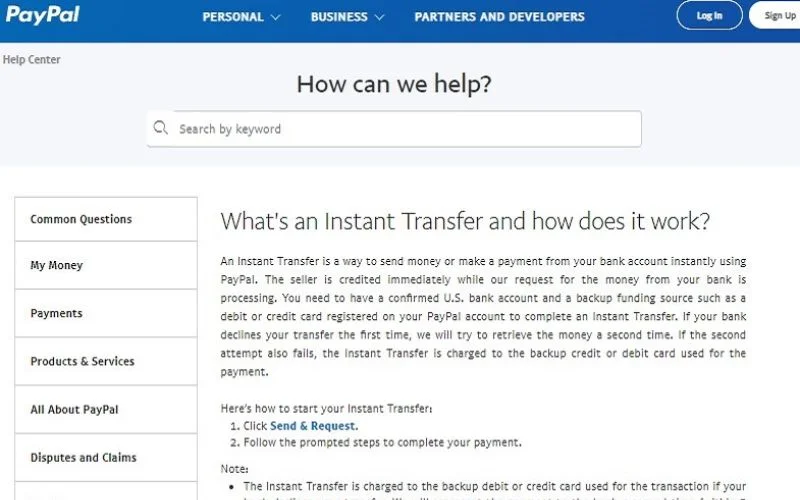

Now that we understand the significance of PayPal Inst Xfer, let’s unravel how this seamless instant transfer process operates.

At its core, PayPal Inst Xfer is designed to expedite the movement of money from one PayPal account to another, or more specifically, from your PayPal account to the recipient’s PayPal account. The process is straightforward and user-friendly, making it accessible to individuals from all walks of life.

Here’s a step-by-step breakdown of how PayPal Inst Xfer works:

- Initiating the Transfer: To kickstart the process, log in to your PayPal account. Ensure that your account is linked to a valid and confirmed U.S. bank account. Additionally, it’s advisable to have a backup funding source, such as a credit card or debit card, registered with your PayPal account. This step is vital to ensure a seamless transaction process.

- Select the Recipient: Enter the email address, name, or mobile number of the person you intend to send money to and click “Next.” This step ensures that the funds are directed to the correct PayPal account.

- Specify the Amount: Enter the amount you wish to transfer and proceed to the next step. PayPal provides a convenient “Continue” button to facilitate the process.

- Payment Method: At this stage, you’ll have the option to choose your preferred payment method. Select “Instant Transfer” to enjoy the benefits of instant money transfer. Confirm the information, and if everything is accurate, click “Send Money.”

- Transaction Completion: Once you’ve clicked “Send Money,” the magic of PayPal Inst Xfer begins. Your funds are immediately credited to the recipient’s PayPal account. The beauty of this process lies in its speed; the money is available to the recipient within minutes if not seconds.

One of the key features of PayPal Inst Xfer is its ability to access an alternative funding source if your primary source, typically your bank account, fails to cover the transaction. PayPal will attempt to retrieve the funds for a second time from your bank account. If this attempt is unsuccessful, PayPal will charge the payment to your backup credit card or debit card while applying the Instant Transfer fee.

Advantages of Instant Transfers

The benefits of PayPal Inst Xfer extend beyond its speed and convenience. Let’s delve into the advantages that make this service a preferred choice for many users.

- Speed: Traditional bank transfers can take days to clear, causing delays in payments and transactions. PayPal Inst Xfer eliminates this waiting time, making it ideal for urgent financial needs.

- Ease of Use: The user-friendly interface of PayPal simplifies the process for both beginners and experienced users. The steps are intuitive and easy to follow, ensuring a hassle-free experience.

- Security: PayPal takes security seriously and employs advanced measures to protect your transactions and personal information. This commitment to security is particularly important in the digital age, where online financial transactions are vulnerable to threats.

- Accessible: PayPal Inst Xfer is available to a wide range of users, from individuals making personal transactions to businesses conducting transactions with suppliers and clients. Its versatility makes it a valuable tool in various financial scenarios.

- Backup Funding: The option to link backup funding sources, such as credit cards and debit cards, adds an extra layer of convenience and reliability to the instant transfer process.

- Immediate Availability: The funds transferred via PayPal Inst Xfer are immediately available to the recipient, allowing them to use the money without delay.

PayPal Instant Transfer to Bank Account

While PayPal Inst Xfer primarily focuses on instant transfers between PayPal accounts, PayPal also offers the ability to transfer funds instantly to a linked U.S. bank account. This provides users with the flexibility to choose between transferring money to their PayPal balance or directly to their bank account.

Is PayPal Instant Transfer a Scam?

One common concern among PayPal users is the appearance of unexpected charges, such as the “Withdrawal PayPal Inst Xfer” charge on their bank statements. In some cases, users may not recall initiating such a transfer and may be apprehensive about potential scams.

It’s essential to distinguish between legitimate PayPal Inst Xfer transactions and fraudulent activities. While scams do exist in the realm of online finance, PayPal Inst Xfer itself is a genuine and secure service provided by PayPal to facilitate instant money transfers.

However, to ensure your financial security, it’s crucial to stay vigilant and monitor your PayPal transactions regularly. If you come across any unfamiliar or unauthorized transactions, it’s advisable to contact PayPal’s customer service promptly.

What Does Ach Hold Paypal Inst Xfer Mean?

You might come across the term “Ach Hold Paypal Inst Xfer” on your bank statement and wonder about its significance. This notation indicates that a payment you’ve previously authorized is in the process of being deducted from your account.

In essence, it serves as a notification that the payment has not yet reached the recipient’s account but is in the pipeline. Your bank temporarily places a hold on the corresponding amount to ensure it’s available for settlement.

This practice is part of the Automated Clearing House (ACH) process, a vital component of online transfers. It ensures that payments are accounted for and properly processed.

You May Have Caused the PAYPAL INST XFER Charge Without Knowing

One common scenario that can lead to the “Withdrawal PayPal Inst Xfer” charge on your bank statement is forgetting that you’ve opted for this service. When you place an order or need to send money urgently, PayPal Inst Xfer offers a swift solution. However, it’s essential to be aware of the transactions you initiate.

Your financial records may not always align with your memory, and it’s possible to overlook or forget about certain transactions. PayPal Inst Xfer, being an instant and efficient service, can sometimes lead to unexpected charges if you’re not keeping track of your online activities.

To avoid surprises on your bank statements, it’s advisable to maintain a clear record of your PayPal transactions and regularly review your financial statements. Being proactive in understanding your financial activity can prevent confusion and concerns related to unexpected charges.

Check with PayPal If There Is Any Doubt

If you ever encounter an unfamiliar charge or have doubts about a transaction related to PayPal Inst Xfer, don’t hesitate to contact PayPal’s customer service for clarification and assistance. They are available to help users resolve issues and provide guidance on any concerns they may have.

PayPal’s commitment to customer satisfaction includes offering reliable support to address inquiries, resolve disputes, and ensure that users have a positive experience when using their services.

How to Stop PayPal Inst Xfer?

PayPal Inst Xfer provides a convenient way to transfer money instantly, but what if you need to cancel a transaction? While instant transfers are designed for speed and efficiency, there are situations where you may want to halt the process.

Here’s how to stop PayPal Inst Xfer:

- Log In to Your PayPal Account: Start by logging in to your PayPal account. This step ensures that you have access to your transaction history and the necessary tools to manage your transfers.

- Access Your Activity: Navigate to the “Activity” section within your PayPal account. This section provides an overview of your recent transactions and transfers.

- Locate the Transaction: Find the specific transaction that you wish to cancel. PayPal typically allows for a very short window to cancel a transaction, so prompt action is essential.

- Check for a “Cancel” Link: PayPal provides a “Cancel” link next to transactions that are eligible for cancellation. If you see this link, click on it to initiate the cancellation process.

- Confirm Cancellation: Follow the on-screen instructions to confirm the cancellation of the transaction. PayPal will guide you through the steps to ensure that the transfer is successfully stopped.

It’s important to note that the availability of the “Cancel” link is time-sensitive. Once a transaction has been processed, it may no longer be possible to cancel it through PayPal’s interface. In such cases, you may need to contact the recipient and request a refund.

How to Cancel a Preapproved Payment

In addition to individual transactions, PayPal users can set up preapproved payments, which grant merchants permission to charge their PayPal account for recurring purchases. If you wish to cancel a preapproved payment, follow these steps:

- Log In to Your PayPal Account: Begin by logging in to your PayPal account, ensuring that you have access to your payment settings.

- Access Payment Settings: Navigate to the “Settings” section, typically represented by a gear icon, located in the top right corner of the page.

- Manage Preapproved Payments: Within the settings, you’ll find an option to “Manage pre-approved payments.” Click on this option to view a list of your preapproved payments.

- Select the Merchant: Locate the name or email of the merchant associated with the preapproved payment you wish to cancel. Click on it to access the payment details.

- Initiate Cancellation: Within the payment details, you should find an option to “Cancel” the preapproved payment. Follow the prompts to confirm the cancellation.

Cancelling a preapproved payment stops future PayPal Inst Xfer charges associated with that merchant. However, it’s essential to note that it doesn’t cancel any existing contracts or refund previous payments made to the merchant. If you’ve already received goods or services, you are still responsible for the associated charges.

Is It an Adequate Alternative?

While PayPal Inst Xfer offers numerous benefits, including speed and convenience, it’s essential to evaluate whether it’s the right choice for your specific financial needs. Like any financial service, PayPal Inst Xfer has its limitations and considerations.

Some users may find that using instant transfers is most suitable when the need for sending or receiving money is urgent, such as purchasing a product that requires immediate delivery. However, it’s essential to be aware that certain fees may apply, and these fees can vary based on the transaction amount.

It’s also worth noting that some users have reported inconveniences or interest deductions months after completing a transfer, which may affect the overall cost of the service. Therefore, before using PayPal Inst Xfer, it’s advisable to explore all available alternatives and carefully follow the procedure to ensure that your financial transactions are conducted accurately and cost-effectively.

Real-Life Inst Xfer Experiences

To provide a well-rounded understanding of PayPal Inst Xfer, let’s delve into some real-life experiences shared by users who have utilized this service to meet their financial needs:

User A – Swift Business Transactions: Susan, a small business owner, relies on PayPal Inst Xfer to promptly settle payments with her suppliers and contractors. She appreciates the speed at which funds are transferred, allowing her to maintain strong business relationships and keep her operations running smoothly.

User B – Convenient Online Shopping: Mark, an avid online shopper, often uses PayPal Inst Xfer to pay for his purchases. He enjoys the convenience of instant transfers, especially when ordering items with immediate delivery. Mark has found this service to be a game-changer for his online shopping experience.

User C – Personal Financial Emergencies: John recently faced a financial emergency and needed to send money urgently to a family member. PayPal Inst Xfer came to the rescue, allowing him to provide assistance promptly. John’s experience highlights the valuable role of instant transfers in personal financial emergencies.

Conclusion

In conclusion, PayPal Inst Xfer has revolutionized the way we handle financial transactions, offering a fast, secure, and convenient method of transferring money instantly. While it’s essential to stay vigilant and monitor your financial activities, PayPal Inst Xfer remains a legitimate and valuable service provided by PayPal.

The advantages of speed, ease of use, security, and accessibility make it a preferred choice for many individuals and businesses. Whether you’re settling bills, making online purchases, or responding to financial emergencies, PayPal Inst Xfer can be a reliable solution to meet your immediate needs.

As PayPal continues to expand and enhance its services, including plans to introduce Instant Transfer to more countries, users can look forward to even greater flexibility in managing their finances. While exploring the world of online financial transactions, it’s crucial to prioritize security, stay informed, and make the most of the tools and services available to simplify your financial journey.

PayPal Inst Xfer is more than just a service; it’s a testament to the evolution of modern finance, where speed and convenience play a pivotal role in meeting the dynamic demands of our digital age. Embrace the possibilities of instant transfers and experience the financial world at your fingertips.