Introduction

In today’s global economy, understanding and applying the Goods and Services Tax (GST) has become a critical part of doing business. GST, a value-added tax levied on most goods and services sold for domestic consumption, is a cornerstone of modern fiscal policies. This tax helps nations raise revenue without penalizing income, thereby fostering a more equitable economic environment. Given the complexities of calculating GST across different products and services, GST calculators have emerged as essential tools for businesses and consumers alike. This article delves into the mechanics of GST calculators, their benefits, the pivotal role of GST in economies, and a comparative analysis of GST systems in New Zealand and India.

What is a GST Calculator?

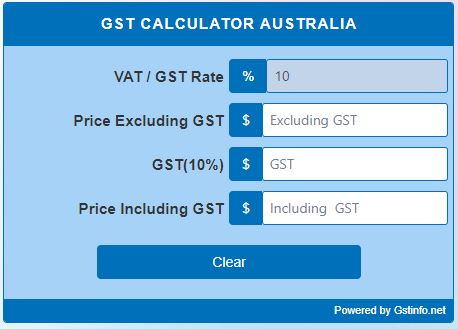

A GST calculator is an online or software-based tool designed to simplify the calculation of Goods and Services Tax on the sale or purchase of goods and services. By inputting the net amount of a product or service and the applicable GST rate, users can quickly determine the total cost including GST or the GST amount itself. This tool is invaluable for businesses, accountants, and consumers who need to calculate GST accurately and efficiently.

How Does a GST Calculator Work?

The operation of a GST calculator is straightforward yet powerful. At its core, the calculator takes the base price of an item and applies the specified GST rate to compute the gross amount (including GST) or the GST component of the total price. Here’s a step-by-step breakdown:

- Input the Base Price: The user enters the net price of the good or service.

- Select the GST Rate: The user selects the appropriate GST rate, which can vary depending on the country and the type of product or service.

- Calculate: The calculator then computes either the total amount including GST or the GST amount, depending on the user’s needs.

This process demystifies the often complex calculations involved in GST compliance, ensuring accuracy and saving time.

Benefits to Users

GST calculators offer several advantages, including:

- Accuracy: They reduce human error in calculations, ensuring businesses charge and claim the correct GST amounts.

- Efficiency: Instant calculations make it easier to manage invoices and financial statements, especially for businesses with a high volume of transactions.

- Compliance: Accurate GST calculations help maintain compliance with tax authorities, avoiding penalties and audits.

- Decision Making: Understanding the tax implications of transactions aids in better pricing strategies and financial planning.

Why GST is Important

GST streamlines the taxation system, replacing multiple indirect taxes with a single tax. This simplification reduces the tax burden on producers and fosters growth through more trade. GST’s transparency and self-policing nature also enhance compliance and reduce tax evasion. It’s a critical revenue source for governments, funding public services and infrastructure development.

GST in New Zealand

Implementation and Rate: New Zealand introduced GST in 1986, establishing it as a comprehensive, value-added tax on the sale of most goods and services, including imports. The GST rate in New Zealand is 15%. This rate has been increased twice since its introduction; it was initially set at 10%, then raised to 12.5% in 1989, and to 15% in 2010.

Coverage and Exemptions: New Zealand’s GST is known for its broad base and minimal exemptions. Unlike many other countries, New Zealand does not exempt food, healthcare, or education services, which simplifies the tax system and reduces compliance costs. Notable exemptions include financial services and residential rent.

Administration: The Inland Revenue Department (IRD) is responsible for GST administration in New Zealand. GST-registered businesses must file returns, usually every one, two, or six months, based on their turnover or preferences. The system is designed to be simple, aiming to keep compliance costs low for businesses.

Impact: The simplicity and broad base of New Zealand’s GST system have been praised for their efficiency and ease of administration. The GST in New Zealand is credited with providing a stable revenue stream while minimizing economic distortions.

GST in India

Implementation and Rates: India rolled out its GST system on July 1, 2017, replacing a complex and fragmented tax structure that included multiple indirect taxes levied by the central and state governments. India’s GST is structured into four main rates: 5%, 12%, 18%, and 28%, applied based on the type of goods or services. Additionally, some products, like luxury items and tobacco, attract cesses over and above the highest GST rate.

Coverage and Exemptions: India’s GST system categorizes goods and services into different tax slabs, with essential items taxed at lower rates or exempted to protect lower-income consumers. Unlike New Zealand, India exempts healthcare and education services entirely from GST. Zero-rated supplies (exports) and supplies to Special Economic Zones (SEZs) are also notable features.

Administration: The GST in India is administered jointly by the central and state governments through the Goods and Services Tax Council. This dual structure aims to balance the fiscal autonomy of the states with the efficiency of a unified national tax system. GST-registered businesses in India must comply with a comprehensive set of filing requirements, including monthly and quarterly returns, which has been a point of contention regarding the system’s complexity and the burden on small businesses.

Impact: The introduction of GST in India has been hailed as a significant reform in the country’s tax system, aimed at creating a single national market and reducing the cascading effect of taxes. However, the system’s complexity, multiple rates, and technical challenges with the GSTN (GST Network) portal have posed challenges for compliance and administration.

Comparative Analysis

- Simplicity vs. Complexity: New Zealand’s GST system is notably simpler, with a single rate and few exemptions, making compliance straightforward. In contrast, India’s GST categorizes goods and services into several tax slabs, aiming to address social equity but at the cost of increased complexity.

- Tax Rates: New Zealand has a single GST rate of 15%, while India uses multiple rates ranging from 0% to 28%, plus additional cesses for certain goods.

- Administration: GST in New Zealand is administered solely by the IRD, whereas India’s GST involves coordination between the central and state governments, reflecting a more complex governance structure.

- Impact on Businesses: The simplicity of New Zealand’s GST system minimizes compliance costs for businesses. In India, while the intent is to streamline the tax regime, small and medium enterprises (SMEs) have faced challenges in adapting to the new system and complying with its requirements.

Both New Zealand and India have taken significant steps toward simplifying their tax systems through the implementation of GST. New Zealand’s approach emphasizes simplicity and broad coverage, while India’s system seeks to balance economic growth with social equity, despite the complexities involved. As both countries continue to refine their GST systems, they offer valuable lessons on the impact of tax policy on economic efficiency and equity.

Conclusion

Understanding and managing GST is crucial for businesses and consumers worldwide. GST calculators simplify this task, promoting accuracy, efficiency, and compliance. While GST systems vary by country, their objectives are similar: to streamline taxation, reduce economic distortions, and fund public goods. As global economies evolve, tools like GST calculators and nuanced tax policies will continue to play vital roles