Embarking on the journey of becoming a homeowner is a step. However, navigating the complexities of mortgage financing can be quite overwhelming. This is where licensed mortgage brokers come in. They play a role as guides throughout the home-buying process. In this guide, we will explore the multifaceted responsibilities and expertise of mortgage brokers highlighting the numerous benefits they offer to prospective homebuyers.

Understanding Mortgage Brokering Fundamentals

Navigating the complexities of real estate financing can be a daunting task, making the role of mortgage brokers indispensable. In this exploration of Understanding Mortgage Brokering Fundamentals, we delve into the key principles that underpin this critical aspect of the home-buying process. From demystifying jargon to unraveling the intricacies of loan options, this guide aims to empower you with the knowledge needed to make informed decisions on your homeownership journey.

Defining the Role of Mortgage Brokers

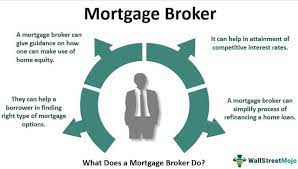

Licensed mortgage loan brokers act as intermediaries, between homebuyers and lenders. Their main objective is to assist borrowers in securing mortgage financing by evaluating their situation exploring loan options and facilitating the loan application process.

Licensed and Regulated Professionals

Mortgage brokers function within a regulated framework that necessitates licensing in jurisdictions. These licenses are acquired through training and examinations to ensure that brokers adhere to standards and possess the necessary knowledge to guide clients through the intricate world of mortgages.

The Benefits of Engaging a Licensed Mortgage Broker

In the complex landscape of real estate financing, the guidance of a licensed mortgage broker can be a game-changer. Navigating the intricacies of mortgage options requires expertise, and a licensed broker brings a wealth of knowledge to the table. In this article, we explore the myriad benefits of engaging a licensed mortgage broker, shedding light on how their professional insight can streamline the path to homeownership and financial success.

Access to a Range of Lenders

One of the advantages of working with a licensed mortgage broker is their extensive network of lenders. Brokers have connections to institutions, such as banks, credit unions, and private lenders. This allows them to find the loan terms and conditions for borrowers.

Tailored Mortgage Solutions

Licensed mortgage brokers take an approach to each client’s situation. They thoroughly evaluate factors like income, credit history, and financial goals to create customized mortgage solutions that meet needs. This level of customization increases the likelihood of obtaining a mortgage that aligns with the buyer’s circumstances.

Expert Negotiation Skills

Mortgage brokers possess negotiation skills acquired through their interactions with lenders. Their expertise enables them to secure interest rates, favorable loan terms, and lower closing costs on behalf of their clients. Effective negotiation can result in savings, throughout a mortgage.

Simplifying the Application Process

Navigating the time-consuming mortgage application process can be challenging. Licensed mortgage brokers simplify this process by managing paperwork liaising with lenders and ensuring all documentation is complete and accurate. Not only does this help homebuyers save time. It also reduces the chances of potential delays or complications.

Financial Guidance and Education

Licensed mortgage brokers play a role, in providing guidance and education to homebuyers. They simplify mortgage terms explain loan options and offer insights into the consequences of various financing choices. This empowers buyers to make decisions that align with their long-term financial goals.

The Mortgage Brokering Process in Detail

Embarking on the journey of securing a mortgage involves a detailed and intricate process that requires careful navigation. From initial consultation to the final loan approval, the mortgage brokering process is a crucial step in realizing homeownership dreams. In this exploration, we delve into the intricacies of each stage, unraveling the layers of the mortgage journey for a comprehensive understanding.

Initial Consultation

The journey with a mortgage broker typically begins with a consultation. During this meeting, the broker collects information about the homebuyer’s situation, objectives, and preferences. This thorough understanding serves as a basis for customizing mortgage recommendations.

Loan Shopping and Comparison

Armed with the borrower’s details the mortgage broker embarks on finding suitable loan options. This includes comparing interest rates, loan terms, and any associated fees, from lenders to identify the favorable choices.

Application Submission

Once the homebuyer chooses their mortgage option the broker assists in completing the loan application process. The broker ensures that all necessary documentation is accurately compiled and submits it to the selected lender.

Negotiating and Finalizing

During the underwriting process, the mortgage broker acts as a mediator, between the borrower and the lender. They discuss terms address concerns and strive to achieve the possible outcome for the homebuyer. As the closing date approaches the broker continues to facilitate communication to ensure a transition into homeownership.

Support after Closing

The role of a mortgage broker doesn’t end with closing. Many brokers offer assistance by helping with any closing questions, refinancing options or future mortgage-related needs. This long-term relationship adds value to working with a mortgage broker.

Conclusion

Choosing a mortgage broker is a beneficial move for anyone navigating through the complexities of buying a home. These professionals bring expertise, negotiation skills, and access to a network of lenders all of which contribute to obtaining favorable mortgage terms for homebuyers. By serving as guides, advocates and financial educators licensed mortgage brokers play a role in simplifying the journey, toward homeownership. They ensure that individuals confidently step into their homes with mortgages that align with their goals and aspirations.