In today’s digital age, where cash transactions are becoming increasingly rare, debit cards have become an essential tool for managing finances.

With the convenience they offer, debit cards have simplified the way we pay for goods and services.

However, despite their convenience, disputes may arise with debit card transactions, leading to unauthorized charges or discrepancies on your account.

Understanding how to resolve these disputes effectively is crucial to safeguarding your finances and ensuring peace of mind.

In this comprehensive guide, we will delve into everything you need to know about resolving dispute charges on your debit card.

Understanding Debit Card Disputes

Debit card disputes can arise for various reasons, including unauthorized transactions, billing errors, merchant disputes, or fraud.

Regardless of the cause, it’s essential to address these issues promptly to avoid financial losses and protect your account security.

Unauthorized Transactions: If you notice unfamiliar dispute charges on debit card, it could indicate unauthorized transactions. These transactions may result from stolen card information, identity theft, or fraudulent activities.

Billing Errors: Billing errors can occur due to technical glitches, double charges, or incorrect transaction amounts. Monitoring your account regularly can help identify such discrepancies.

Merchant Disputes: Sometimes, disputes arise due to unsatisfactory goods or services received from a merchant. In such cases, you may dispute the charge if the merchant fails to resolve the issue satisfactorily.

Fraudulent Activities: Debit card fraud is a significant concern, with cybercriminals employing various tactics to gain access to card information. It’s crucial to remain vigilant and report any suspicious activity promptly.

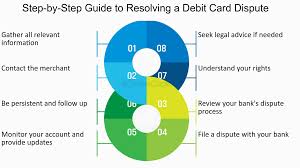

Steps to Resolve Dispute Charges

Resolving dispute charges on your debit card involves a systematic approach to ensure a swift and satisfactory resolution. Follow these steps to navigate the process effectively:

Review Your Account Statements: Regularly review your debit card statements to identify any unauthorized or suspicious transactions promptly. Pay attention to unfamiliar charges, duplicate transactions, or billing errors.

Contact the Merchant: If you notice a discrepancy related to a specific purchase, reach out to the merchant first. Explain the issue and provide relevant details, such as the transaction date, amount, and any supporting documentation. Many disputes can be resolved amicably at this stage.

Notify Your Bank: If you’re unable to resolve the issue with the merchant, contact your bank or financial institution immediately. Most banks have a dedicated customer service hotline or online portal for reporting debit card disputes. Provide detailed information about the disputed transaction and any communication with the merchant.

File a Dispute Form: In many cases, your bank will require you to fill out a dispute form to initiate the investigation process formally. Provide accurate information and documentation to support your claim, such as receipts, order confirmations, or communication with the merchant.

Temporary Credit: Depending on your bank’s policies, you may receive a temporary credit for the disputed amount while the investigation is underway. This provisional credit helps mitigate any financial impact on your account during the dispute resolution process.

Investigation Process: Once you’ve filed a dispute, your bank will investigate the matter by reviewing transaction records, communicating with the merchant, and examining any available evidence. The investigation process may take several weeks, during which you’ll receive regular updates from your bank.

Resolution: After completing the investigation, your bank will notify you of the outcome. If the dispute is resolved in your favor, the disputed amount will be permanently credited to your account. However, if the bank determines that the charge is valid, you’ll be informed accordingly.

Appeal Process: If you disagree with the outcome of the investigation, most banks offer an appeal process. You may be required to provide additional evidence or documentation to support your claim during the appeal.

Tips for Preventing Disputes

While resolving disputes is essential, taking proactive measures to prevent them is equally important. Here are some tips to help safeguard your debit card transactions:

Monitor Your Account: Regularly review your account statements and transaction history for any unauthorized or suspicious activity. Report any discrepancies to your bank immediately.

Protect Your Card Information: Keep your debit card information secure and avoid sharing it with unauthorized parties. Be cautious when using your card for online transactions, and only provide your card details on secure websites.

Enable Alerts: Many banks offer account alert services that notify you of any unusual activity on your account, such as large purchases or transactions from unfamiliar locations. Enable these alerts to stay informed and detect potential fraud early.

Use Secure Payment Methods: When making purchases online or at retail stores, opt for secure payment methods such as chip-enabled cards or mobile wallets. These methods offer enhanced security features that help protect your card information.

Be Wary of Phishing Scams: Beware of phishing scams where fraudsters attempt to obtain your card information through deceptive emails, text messages, or phone calls. Never provide sensitive information in response to unsolicited requests.

Keep Records: Maintain records of your transactions, including receipts, order confirmations, and correspondence with merchants. These documents can serve as valuable evidence in case of disputes.

Conclusion

Debit cards offer convenience and flexibility in managing your finances, but disputes can occasionally arise, leading to inconvenience and potential financial losses.

By understanding the process of resolving dispute charges and taking proactive steps to prevent fraud, you can protect yourself from unauthorized transactions and ensure a secure banking experience.

Remember to monitor your account regularly, communicate effectively with merchants and financial institutions, and stay vigilant against fraudulent activities.

With the right knowledge and precautions, you can navigate debit card disputes effectively and safeguard your financial well-being.